A DISCIPLINED PORTFOLIO MANAGEMENT APPROACH

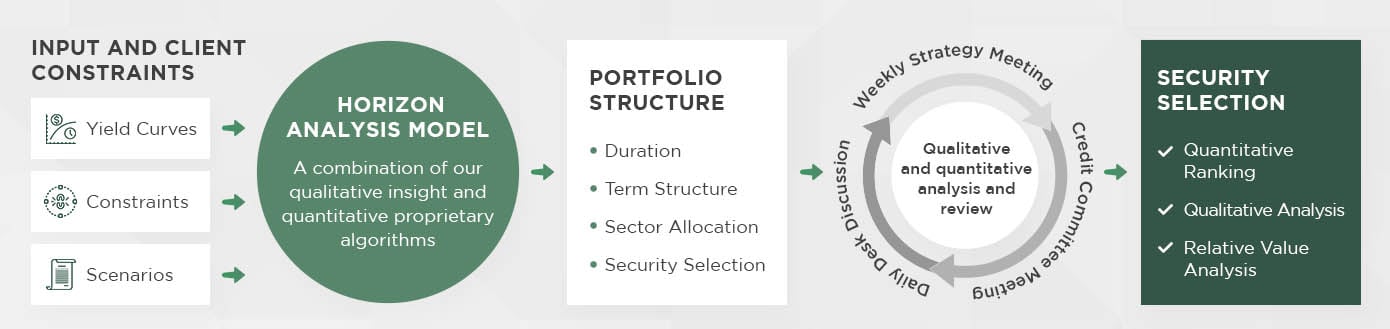

To consistently add value to client portfolios across all economic and market cycles, we adhere to a disciplined, well-defined process. Our proprietary Horizon Analysis Model is the quantitative foundation for Chandler’s portfolio construction process. The Model enables the portfolio management team to integrate its research into the portfolio management process in a quantitative, disciplined, and repeatable way. Inputs to the Model include:

- Current yields on Treasury, agency and corporate securities

- Specific client constraints, such as maturity restrictions and maximum sector exposure; and

- A thorough range of forecasted interest rate scenarios based upon a six-month horizon date.

Through an iterative process, the Model generates what we believe is the “optimal portfolio structure” (duration, maturity distribution & sector allocation), which is the portfolio designed with the goal of achieving a return greater than the benchmark in each of the interest rate scenarios.

A Disciplined Portfolio Management Approach

To consistently add value to client portfolios across all economic and market cycles, we adhere to a disciplined, well-defined process. Our proprietary Horizon Analysis Model is the quantitative foundation for Chandler’s portfolio construction process. The Model enables the portfolio management team to integrate its research into the portfolio management process in a quantitative, disciplined, and repeatable way. Inputs to the Model include:

- Current yields on Treasury, agency and corporate securities.

- Specific client constraints, such as maturity restrictions and maximum sector exposure.

- A thorough range of forecasted interest rate scenarios based upon a six-month horizon date.

Our Investment Process

Our proprietary quantitative process suggests portfolio structures

Portfolio Fundamentals

We believe that actively managing fixed income portfolios using robust quantitative analysis and qualitative insights can provide superior risk-adjusted returns across a broad range of market environments. The objective of our disciplined management process is to build a portfolio we expect will exceed benchmark returns over a range of market conditions without the assumption of undue risk. To pursue this goal, we focus on the fundamental elements that create value in fixed income portfolios: duration, sector allocation, yield curve management and security selection.