An already slow week for economic data, due to the holiday closure on Monday, was inhibited even...

Views and Perspectives on Markets

Chandler Asset Management offers a wealth of knowledge in our many experienced professionals. The resources listed below provide you with valuable information, including market news and conditions, financial insights, and explanations of the market environment.

Chandler’s publications highlight conditions in the fixed income markets and economic indicators that may affect the bond markets, the yield curve, and Treasury yield spreads. Our weekly and monthly communications, whitepapers authored by investment professionals, participation at industry conferences and events, and other insights and news articles are below. If you would like to receive an electronic monthly copy of the Bond Market Review newsletter or be added to any other mailing lists, please CONTACT US.

Showing n out of 8 resources

Nothing found...

9/19/25: Fed Cuts Rates, Turns Attention to Labor Market

The Federal Reserve (Fed) lowered the federal funds rate target range by 25 basis points to 4.00%...

9/12/25: Fed Rate Cut Likely as Inflation Cools

This week’s inflation data reaffirmed the likelihood of a Fed easing at their upcoming meeting on...

8/15/25: Inflation Pressure Rises, While Confidence Falls

Financial markets focused on inflation and the consumer this week. The Consumer Price Index (CPI)...

5/30/25: Markets Rally on Tariff Delay and Confidence Rebounds

This week featured a variety of key data points measuring the health of the US economy along with...

3/7/25: Markets Whipsawed by Trump’s Tariff Policy

Markets were whipsawed this week by President Trump’s tariff policy announcements, triggering the...

2/14/25: US Economic Update: CPI, PPI, Retail Sales, and Treasury Rates

This week’s economic data provided valuable insight into the state of the consumer and inflation....

1/31/25: Inflation, GDP, Job Market, and Fed's Stance on Monetary Policy

The last week of January concluded with several key economic data releases related to the current...

1/10/25: Resilient U.S. Labor Market Drives Economic Outlook

Market participants focused on better-than-expected labor market data this week, highlighting the...

11/22/24: Financial Markets Calm Before Thanksgiving

Financial markets assumed a less volatile tone this week as we approach the Thanksgiving holiday....

11/8/24: US Fixed Income Markets Face Volatility Amid Election Uncertainty and Fed Rate Cut

Nov 8, 2024

The US National Debt: History and Impact of Budget Deficits

As of September 30, 2024, the U.S. population is 337.2 million, and the national debt has reached...

9/13/24: Inflation Data for August Signals Key Fed Rate Decision

The market received key inflation data this week that will help inform the Fed’s rate decision on...

8/23/24: Fed Chair Powell's Jackson Hole Speech Signals Potential Rate Cuts Amidst Easing Inflation and Employment Risks

Aug 23, 2024

7/26/24: Q2 GDP Beats Expectations, Inflation Moderates, and Key Market Indicators for July

Jul 26, 2024

7/19/24: 2024 Monetary Policy Outlook: Fed Rate Cut Expected in September Amid Positive Economic Indicators

Jul 19, 2024

7/05/24 - Investors React as Labor Market Shows Signs of Cooling Amid Economic Moderation

In a holiday shortened week investors digested a raft of job-related data which overall continues...

6/28/24 - US Economic Review: Consumer Caution and Moderating Growth

Economic data was plentiful this week, with results reflecting a cautious consumer and moderating...

6/14/24 - May Inflation Data: CPI Unchanged, PPI Declines, Fed Maintains Cautious Stance

Jun 14, 2024

6/7/24 - May's Employment Report Surges: 272K Jobs Added, Unemployment Rate Up to 4.0%

Today’s employment report for May came in hotter than expected, with 272,000 jobs added to the US...

5/31/24 - Treasury Yields Volatile Amid Uncertain Monetary Policy: Analysis & Market Insights

Treasury yields remain volatile as market participants’ view on the trajectory of monetary policy...

5/17/24 - Inflation Focus: PPI and CPI Analysis, Retail Sales Dip, Housing Market Challenges

May 17, 2024

5/3/24 - US Labor Market Moderates in April: Fed Holds Rates, Housing Strong, Consumer Confidence Dips

May 3, 2024

April 2024 – Bond Market Review

As expected at the March meeting, the Federal Open Market Committee voted unanimouslyto leave the...

3/8 - Weekly Economic Highlights

Bond market investors are analyzing Federal Reserve Chair Jerome Powell's recent testimony before...

1/19 - Weekly Economic Highlights

US retail sales delivered a positive surprise, marking the strongest growth in three months. This...

1/5 - Weekly Economic Highlights

Starting off the new year, the December employment report exceeded expectations by adding 216,000...

11/3 - Weekly Economic Highlights

Longer-term interest rates moved lower, and the equity market turned positive on a week-over-week...

September 2023 – Bond Market Review

Recent economic data continues to suggest positive but below trend growth this year. Although the...

August 2023 – Bond Market Review

Recent economic data continues to suggest positive but below trend growth this year. Although the...

July 2023 – Bond Market Review

Recent economic data continues to suggest positive but below trend growth this year. Although the...

7/14 - Weekly Economic Highlights

This week, market participants were focused on inflation and associated implications for monetary...

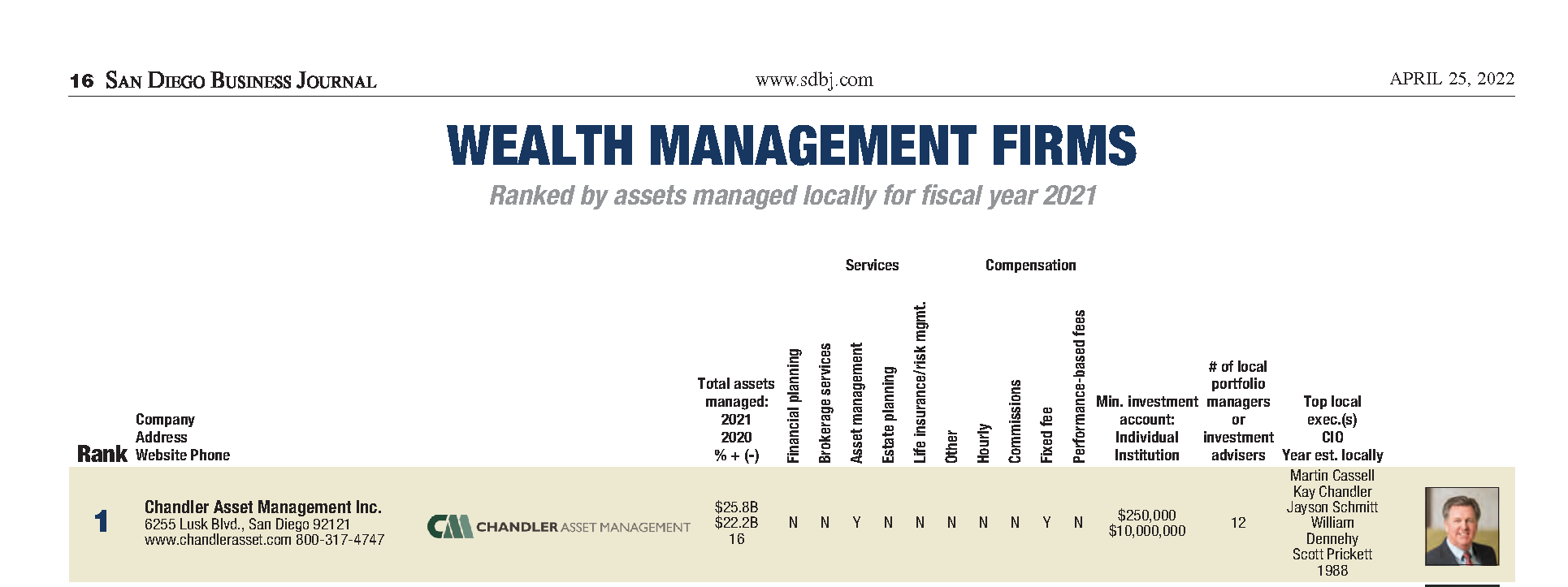

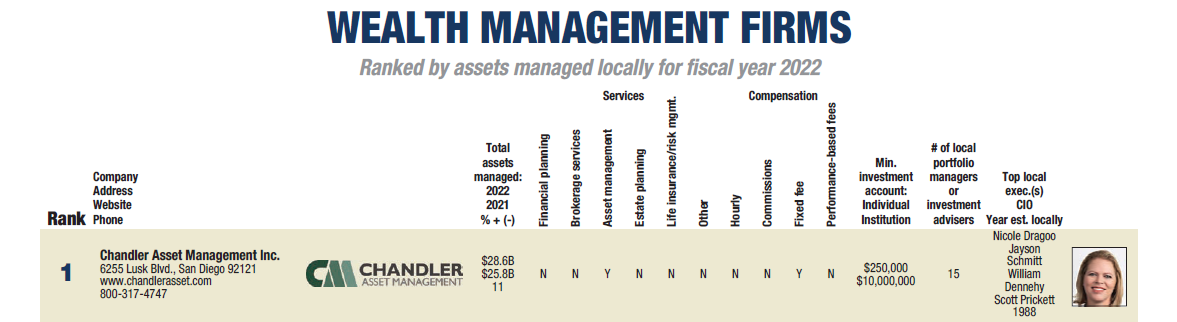

Chandler - SDBJ Wealth Management Firm #1

Chandler Asset Management is proud to be ranked #1 for assets managed locally for the fiscal year...

June 2023 – Bond Market Review

Recent economic data continues to suggest positive but below trend growth this year. Although the...

5/05 - Weekly Economic Highlights

This week market participants were focused on continued stress in the banking sector, the Federal...

4/21 - Weekly Economic Highlights

Although economic data was fairly light this week, there was a full slate of speaking engagements...

4/14 - Weekly Economic Highlights

Investors had a large amount of economic data to process this week, with the March Consumer Price...

3/17 - Weekly Economic Highlights

Economic data this week including top tier inflation data was overshadowed by Silicon Valley Bank...

February 2023 – Bond Market Review

Market volatility has intensified as investors weigh the probabilities of a hard or soft economic...

12/16 - Weekly Economic Highlights

As expected at the December 14th meeting, the Federal Open Market Committee (FOMC) raised the fed...

December 2022 – Bond Market Review

Market volatility has intensified as financial conditions tighten and global central banks pursue...

12/02 - Weekly Economic Highlights

The market received key updates on the state of the US economy this week; the November employment...

October 2022 – Bond Market Review

Market volatility has intensified as financial conditions tighten and global central banks pursue...

8/12- Weekly Economic Highlights

Inflation reports this week indicated the possibility of easing price pressures with both the CPI...

8/5- Weekly Economic Highlights

The U.S. economy added 528,000 jobs in July, more than double market expectations of 250,000, and...

7/15- Weekly Economic Highlights

The market received reports on inflation this week surpassing expectations, likely increasing the...

7/1- Weekly Economic Highlights

The market digested a wide range of key data this week about the health of the US economy, and it...

6/3- Weekly Economic Highlights

The market received a slightly better than expected employment report this morning, supportive of...

4/1- Weekly Economic Highlights

This week featured a robust set of economic data supportive of a more restrictive Federal Reserve...

January 2022 – Bond Market Review

Fed policymakers have recently pivoted toward a more hawkish stance as inflation indices continue...

1/7- Weekly Economic Highlights

Job growth slowed in December, with US nonfarm payroll growth of just 199,000 in the month versus...

12/17- Weekly Economic Highlights

The Federal Open Market Committee (FOMC) kept the fed funds target rate unchanged this week, in a...

Chandler's CCO's Article in Newsweek

Chandler is proud to announce that our Chief Compliance Officer, Joseph Kolinsky, has contributed...

Central Banks to the Rescue

The novel coronavirus pandemic that spread across the globe beginning in late 2019 and early 2020...

10/8– Weekly Economic Highlights

Job growth was weaker than expected in September, but the unemployment rate fell below 5% for the...

8/27– Weekly Economic Highlights

Fed Chair Jerome Powell delivered his speech at the Jackson Hole economic symposium this morning....

7/30– Weekly Economic Highlights

The Federal Open Market Committee (FOMC) kept monetary policy unchanged at its meeting this week....

7/16– Weekly Economic Highlights

The Consumer Price Index (CPI) was up 5.4% year-over-year in June versus up 5.0% in May. Core CPI...

July 2021 – Bond Market Review

We believe the outlook for US economic growth in the second half of the year is strong, fueled by...

7/2– Weekly Economic Highlights

Job growth was stronger than expected in June. U.S. nonfarm payrolls increased by 850,000, versus...

6/18– Weekly Economic Highlights

The Federal Open Market Committee (FOMC) kept monetary policy unchanged at its meeting this week....

Section 115 Trust Considerations for Public Agencies for Funding OPEB Obligations

Across the country, public agencies, corporations, and individuals face the challenges of funding...

5/14– Weekly Economic Highlights

Rising pricing pressure, which the Fed has been expecting, is starting to show up in the data. In...

April 2021 – Bond Market Review

We believe economic growth is poised to accelerate meaningfully in the current quarter as vaccine...